tax avoidance vs tax evasion examples

Tax avoidance unlike tax evasion is a. The effect of tax.

Tax Avoidance And Evasion Free Essay Example

1 Keeping a log of business expenses A.

. Tax evasion is unethical and wrong in both morality and ethics. On the other hand tax avoidance is an option that most people do to minimize their income tax. Common examples of tax evasion include.

Tax Evasion 3 Not reporting interest earned on. 1 Ignoring overseas income This often affects people with rental properties overseas. This is much easier to define as to have.

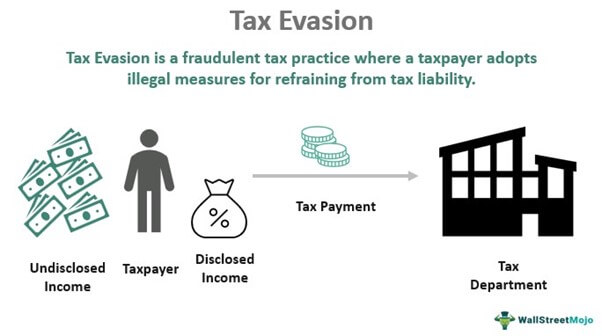

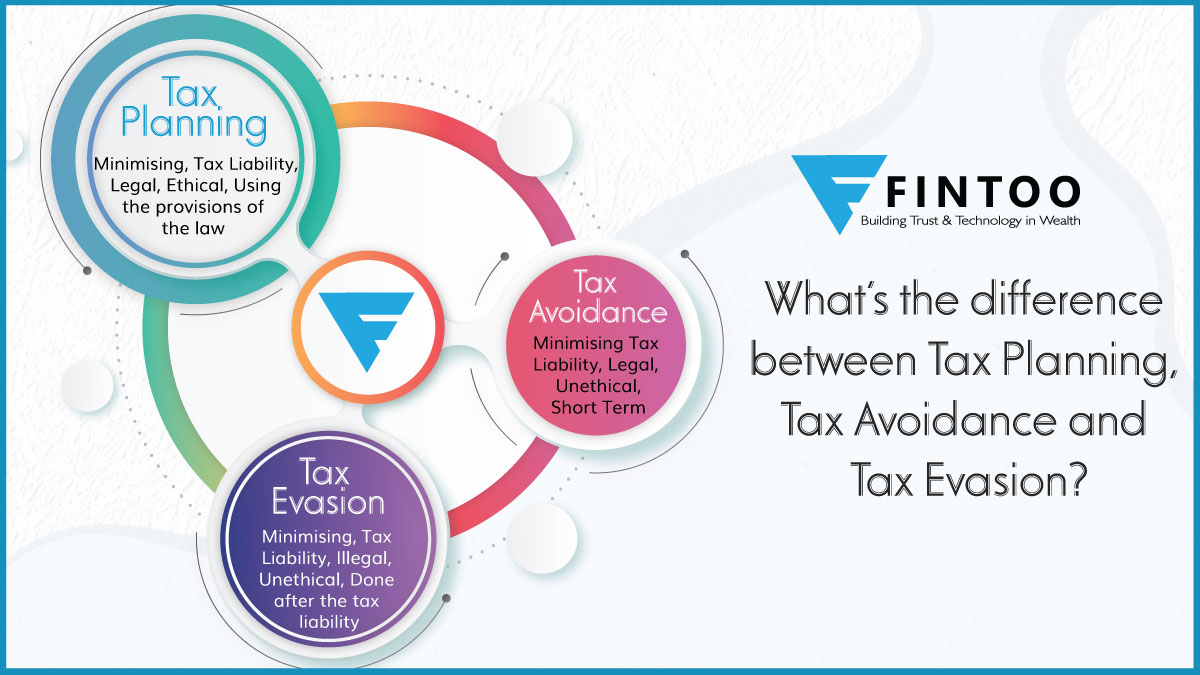

Tax avoidance are unethical since it attempts to manipulate the system without inflicting any harm. There is a clear-cut difference between tax avoidance and tax evasion. Tax evasion is an illegal and fraudulent activity that aims to avoid paying taxes.

One is legally acceptable and the other is an offense. However tax evasion is illegal whereas tax avoidance is legal. Examples of tax evasion include such actions as when a.

Tax Evasion 2 Ignoring earnings from lawn mowing A. The government offers various exemptions like retirement plans mutual funds municipal bonds and tax credits. The examples below are all classed as tax evasion and are therefore illegal.

Depending on where a persons tax evasion crime lands in the set categories they may face a. 2 Banking on Bitcoin The IRS has rules. Tax evasion is when individuals or businesses deliberately decide to commit a crime and allow illegal actions to take place to avoid paying tax.

Tax evasion is often confused with tax avoidance. Canada Revenue Agency states that while tax avoidance is technically within the letter of the law the actions often contravene the object. Tax evasion includes underreporting income not filing tax returns and purposely underpaying taxes.

Tax Evasion vs. Here are some examples of tax evasion. Not reporting or under-reporting income to the tax authorities Keeping business off the books by dealing in cash or other devices with no.

There are prison sentences and hefty fines. Tax avoidance is another way of reducing your tax burden but in a very different way from tax evasion. Deliberately under-reporting income the most common cases include those who run cash.

Avoiding taxes is taking advantage of credits and deductions. Tax evasion is a federal offense.

Definitions Of Tax Avoidance Forms And Tax Evasion Download Scientific Diagram

Pdf Anti Avoidance And Tax Laws A Case Of Fiji Shivneil Raj Academia Edu

Tax Avoidance Vs Tax Evasion Infographic Fincor

Tax Evasion Meaning Types Examples Penalties

Tax Planning Tax Avoidance Tax Evasion Tax Planning Management Taxation Laws Income Tax Youtube

Which Is More Bad Tax Avoidance And Tax Evasion Read To Know More Income Tax News Judgments Act Analysis Tax Planning Advisory E Filing Of Returns Ca Students

Boundaries Of Aggressive Tax Planning Behaviour Retrieved From 19 Download Scientific Diagram

Why Tax Avoidance Is Illicit Ictd

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Difference Between Tax Planning Avoidance Evasion Fintoo Blog

Difference Between Tax Evasion And Tax Avoidance Compare The Difference Between Similar Terms

Tax Evasion And Tax Avoidance Explained Pdf Tax Avoidance And Tax Evasion Explained And Studocu

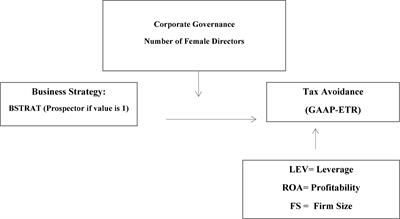

Corporate Business Strategy And Tax Avoidance Culture Moderating Role Of Gender Diversity In An Emerging Economy Frontiers

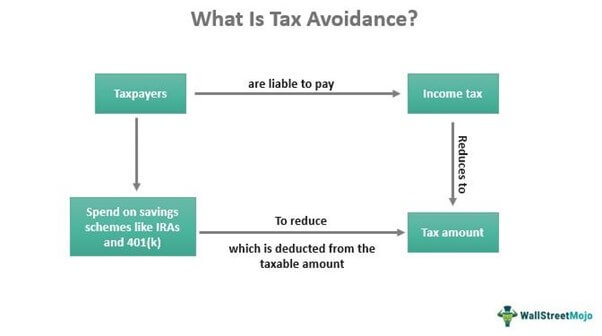

Tax Avoidance Meaning Methods Examples Pros Cons

Tax Avoidance Difference Between Tax Evasion Avoidance Planning

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Chapter 3 Abuse Of Law As A General Principle Of European Union Tax Law In A Guide To The Anti Tax Avoidance Directive